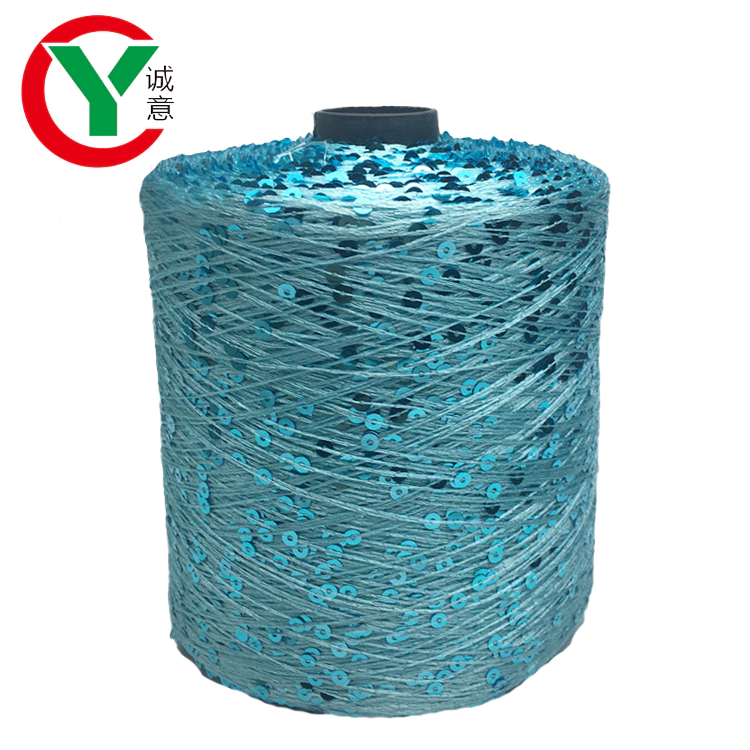

Excellent quality and fashion yarn manufacturer, with over 19 years of the experience in the yarn and textile industry.

Cotton in the international market situation - owned data need to be revised - Textile information - Textile net - Textile integrated service provider

by:Chengyi

2020-07-11

Last week,

On Nov. 27 -

On December 1)

, the ICE futures continue to rise.

Than before due to this year's market environment and obvious changes have taken place, so speculative long positions.

ICE futures contract rose 3 recent months.

2 cents, or 4.

4%.

Main contract rose in March 1.

35 cents, or 1.

9%, up four since the November 14.

6 cents, or up to 6.

7%.

In the 68 -

70 cents a narrow range of running a few months later, the ICE futures finally upward breakthrough, the main reason is that speculative capital started by idling.

Judging from the recent, 2017 annual market changed obviously compared with previous expectations.

Although the planting area, but of the pest in India and Pakistan sharply again lower crop yield and quality of the two countries.

Affected by the global countless data needs to be carefully corrected.

ICE futures rose also lead to higher international cotton prices generally 0.

25 -

2 cents.

Indian cotton export quotation due to insufficient demand does not appear obvious changes, uzbekistan export prices rose sharply.

Domestic cotton prices remain strong in Pakistan, India cotton prices bottomed out stabilizing, Chinese zheng cotton futures prices by ICE futures drive stronger.

Custom message